All small business owners know that it can be a hard road in the beginning. This week, I thought I would research just how hard it is for small businesses in NSW, statistically speaking. I found some interesting things so I thought it was time to ride the Infographic train and put it in pictures! (Explanation below infographic.)

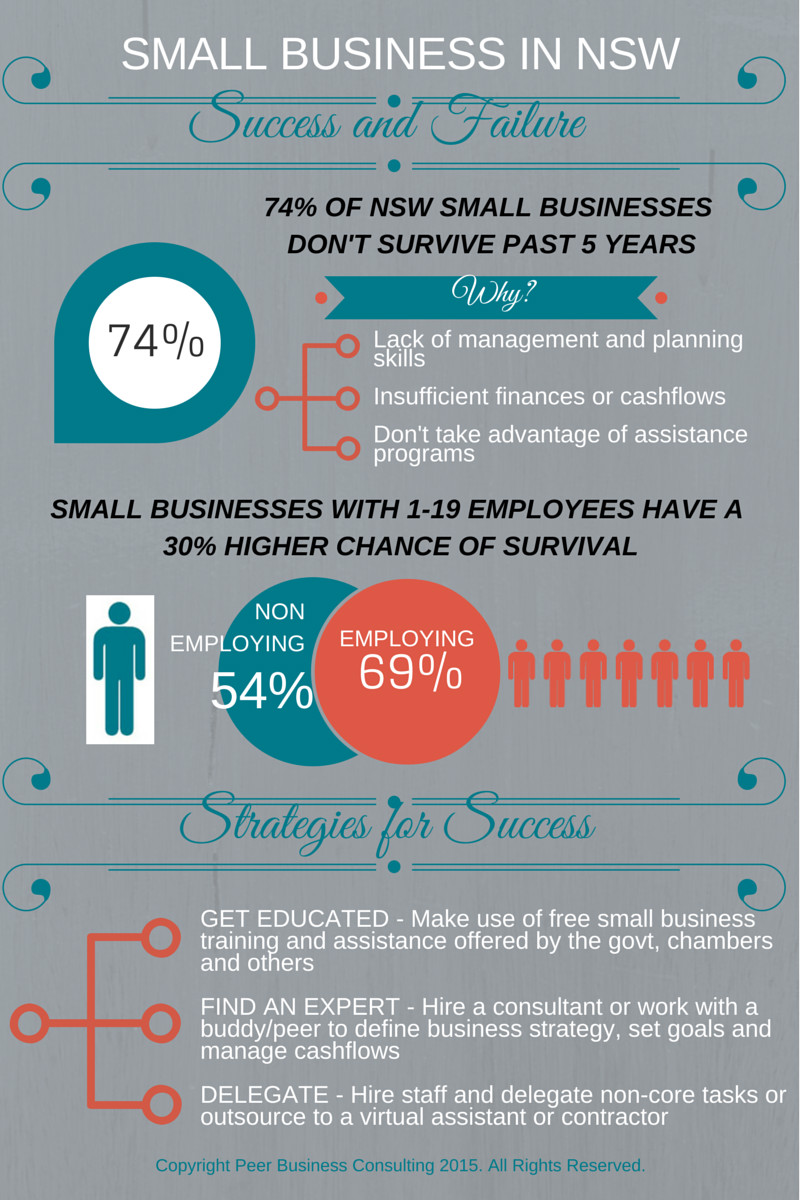

74% of small businesses in NSW don’t survive past 5 years

I’ll be honest. I wasn’t surprised by this. In fact, I thought it would be higher than 74%. But the picture is not that bleak. Looking at the journey of a startup in NSW:

- 32% fail in their first year

- 17% in this second year

- 13% in their third year

- 7% in their forth year

- 5% in their fifth year

So it’s clear that the longer you’re in business, the better your chance of survival.

This might sound obvious to most but the opposite could also have been true. Anecdotally, I know a number of small businesses at the 4-5 year mark who did better in terms of sales, profit and general ease of running their business when they were 1-2 years old. These businesses are going through “growing pains” where they need to look at more efficient ways to handle their increased volumes while keeping costs down.

So why do so many NSW small businesses fail early in their life? A study by the House of Representatives Standing Committee on Industry, Science and Technology found that:

“major causes of small business failure are: a lack of management skills; insufficient finance; and often a failure to take advantage of assistance programs”

Whilst these are pretty major reasons, they can be easily prevented through education and with expert advice. We discuss these strategies for success further below.

Small businesses with 1-19 employees have a 30% higher chance of survival than non-employing small businesses

Another key finding was that the survival rate of small businesses with 1-19 employees was 54%, compared with those with no employees, 69%. This highlights the need for sole traders to get help if they want their business to survive in the long-term. And this help doesn’t have to be in-house staff. There are alternatives.

It’s not all doom and gloom! Here are some strategies for success.

The story doesn’t have to be bleak for small business owners. Here are some simple and cost-effective strategies for a startup and small business to overcome the obstacles that statistics say will lead to their downfall:

1. Get educated

An uneducated business owner is just asking for trouble. Sit down with a pen and paper and make a list of all the areas of running your business that you are unsure about or where you have knowledge gaps. Then create yourself a training plan and get Googling!

There is a multitude of information out there for startups and small business owners, and a LOT of it is free and online. These include: governments small business initiatives offering free information sheets, templates, advice lines, online and face to face workshops; online forums, blogs and startup and small business communities; and business chambers and industry associations.

2. Find an expert or work with a buddy

Inevitably there are areas that no matter how much research you do, will still require expert advice and direction. These include areas such as legal, tax, financial advice, insurance, etc. When deciding if you need to hire an expert, ask yourself: “can I really do this myself?” and “what is the risk if I don’t hire an expert to do this?”.

Sometimes, it’s not an expert you need but just a sounding board, a peer or buddy to bounce ideas with and to challenge you in some of your thinking and the way you do things. This is where being a sole trader doesn’t mean going it alone. Make relationships with other sole traders and small business owners who have succeeded, meet regularly and use each other to help steer you in the right direction and keep you on track.

3. Delegate or outsource

If and when the time comes, don’t be afraid to hire someone or outsource to an external party. If you can’t afford or don’t want the complication of hiring internal staff (with payroll tax, super, workers compensation, training and personal development plans…!) then hire someone on a consulting basis (where they invoice you for their hours worked). Or if virtual assistance or offshoring works for you, this can be a very cheap way of getting administration or repetitive tasks done.

* Data sourced from “Small Business in NSW: Statistical snapshot and recent developments” by Gareth Griffith and John Wilkinson, NSW Parliamentary Research Service, August 2012. (More recent specific data on Australia and NSW small business is not freely available.)

What did you think of this article? Post your comments and questions below. And if you found this useful, please share with your networks.

What did you think of this article? Post your comments and questions below. And if you found this useful, please share with your networks.

About the Author: Angeline Zaghloul is an expert in business strategy, client management and business processes, and is the Principal of Peer Business Consulting, a Sydney-based consultancy providing strategy and operations support to startups and small businesses.

* Portrait by Markus Jaaskelainen.

Very informative infographic, thank you Angeline!

regards

Maryanne

Thanks Maryanne. I’m glad you found it useful. Credit to you for the idea to turn it into a blog post! 🙂