Income diversification. I learned the meaning of this term early in my career in financial services. At that time, the definition that was most relevant for me was this one… “A risk management technique that mixes a wide variety of investments within a portfolio. The rationale behind this technique contends that a portfolio of different kinds of investments will, on average, yield higher returns and pose a lower risk than any individual investment found within the portfolio.”

Income diversification for business owners

That was many years ago and I have since come to learn an extended meaning. “A risk-reduction strategy that involves adding product, services, location, customers and markets to your company’s portfolio.” So yes, it’s still basically saying “don’t put all your eggs in one basket” but this definition talks about extending your offering or location or target market.

It seems counter-intuitive to all the advice out there, which is to define what you do (your core service or product) and be the best at that one thing. But actually it’s not. The key is to do what it takes to mitigate the risk of any one of your income sources drying up. To create some backup options. This doesn’t have to mean moving away from your core service or product. View it as a tweak, rather than a shift.

Income sources mapping technique

Over the last few weeks, I’ve read a lot of articles on this very topic. One which stood out for me was Preston Lee’s My secret to making steady money as a freelance designer, mainly because in the comments, Preston provided an excellent mind map of all his sources of income. Inspired, I decided to draw my own Income Sources map.

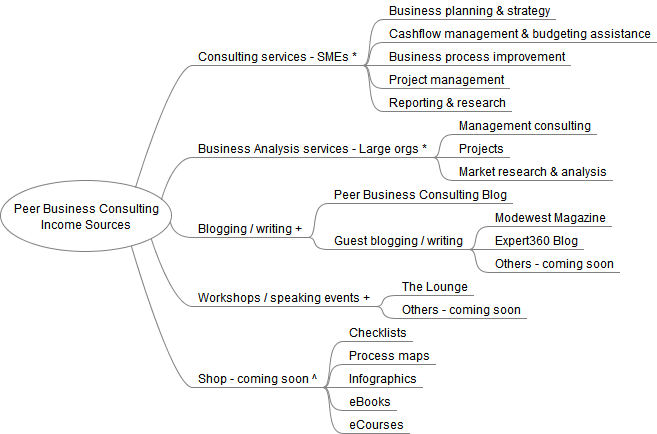

And here it is…

Here is my thought process in creating this mind map:

- I started by noting down all my current income sources, i.e. those I am actually making money from. These are the ones highlighted with an *. It was immediately obvious that my income isn’t diversified enough.

- Then I noted all the other things I currently do that I am not earning an income from. These are the ones marked with a + and include blogging and workshops. The key strategy here is to find ways to earn income from these activities. For example, by offering paid ads in my Blog or by charging a fee for my workshops.

- And finally I added some income sources that I am not doing today (although I have been thinking about these for a little while). This is marked with a ^.

So you can see that this 10-minute exercise helped me to assess how diversified (or not) my income is and has prompted me to think of strategies to rectify this, and in turn mitigate the future risk of my main income source (consulting services to SMEs) drying up.

In summary

Diversification of income is a key strategy used by most successful businesses. Use this simple mind mapping technique to assess the risk to your business of having too few income sources and to establish an action plan to mitigate your risk.

—

* Images sourced from Unsplash and Gratisography.

What did you think of this article? Post your comments and questions below. And if you found this useful, please share with your networks.

What did you think of this article? Post your comments and questions below. And if you found this useful, please share with your networks.

About the Author: Angeline Zaghloul is an expert in business strategy, client management and business processes, and is the Principal of Peer Business Consulting, a Sydney-based consultancy providing strategy and operations support to startups and small businesses.

* Portrait by Markus Jaaskelainen.